The Amazon Cash program bridges the gap between online commerce (using debit or credit cards as payment) and offline commerce, which relies on “cash on delivery” options like cash and gift cards.

Amazon Cash launched in April 2017 to allow customers to deposit cash, without a fee, to a digital account by showing a bar code (either printed physically or digitally) or their phone number linked with their Amazon account at a partner brick-and-mortar retailer, such as CVS or 7-Eleven.

Amazon Cash fits neatly into Amazon’s strategy of appealing to underbanked and unbanked populations — customers only need access to the internet and a printer to open an account, rather than requiring a bank account or a phone.

Prior to Amazon Cash, unbanked and underbanked populations were an unaddressed customer base for the online retailer, as discussed in the Traction section below.

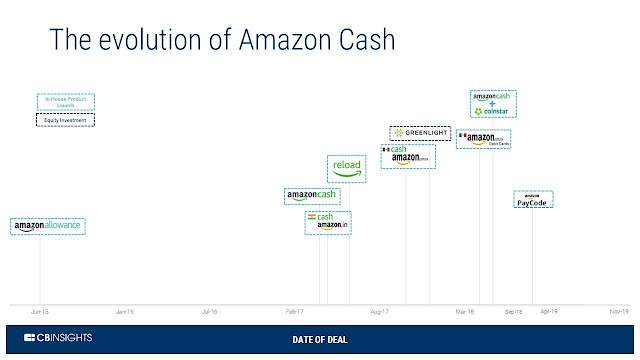

Since Amazon Cash’s launch, Amazon has made a few key product developments

In May 2018, Amazon Cash extended its partnership with Coinstar to allow customers to deposit spare change at Coinstar kiosks and cash out digitally with the Amazon Cash app, instead of in cash or physical gift cards.

Coinstar has nearly 20,000 kiosk locations across mass merchants and select financial institutions. The goal at launch was to enable 5,000 kiosks with the new service by the end of 2018, with Amazon looking to roll out services to more kiosks down the road.

The location of kiosks — typically in grocery stores — is a newer cornerstone of Amazon’s business following its acquisition of Whole Foods. They are also found in high-traffic areas that Amazon competes with, including rival retailers such as Walmart. This partnership helps Amazon encourage customers to spend more on Amazon.com, and fits Amazon’s core strategic goals of strengthening the Amazon ecosystem and increasing participation.

PAYCODE: BRINGING AMAZON OFFLINE WITH WESTERN UNION’S NETWORK

A more recent pillar in Amazon’s fintech strategy is bringing parts of the world without the infrastructure to support digital payments into the Amazon ecosystem.

With PayCode, Amazon is allowing consumers that haven’t previously been able to purchase goods on Amazon to buy items through the site and pay for them in cash via QR codes. Amazon piloted PayCode in countries including Colombia, Chile, Hong Kong, Kenya, Indonesia, Malaysia, the Philippines, Peru, Taiwan, and Thailand. It then expanded the program to Barbados, Costa Rica, Jamaica, Kazakstan, and Uruguay, before opening it to the US in September 2019. PayCode has also been introduced in the Federated States of Micronesia, Marshall Islands, Mauritius, Palau, Philippines, and Tanzania.

The program is a partnership with Western Union, which is providing Amazon with the financial infrastructure it needs to enable offline cash payments. In these regions, consumers can pay for Amazon purchases by visiting a Western Union location and making a deposit in cash.

PayCode gives Amazon a strategic way of assessing which markets might make the most sense for future expansion of Amazon’s core retail platform.

PayCode could also represent a way for Amazon to eventually expand its influence among the underbanked in countries where it already has a live retail market.

AMAZON AND GREENLIGHT: A KID-FRIENDLY SOLUTION

In addition to targeting the unbanked and underbanked, Amazon has looked to leverage the Amazon Cash feature to tap into the next generation of consumers.

In mid-2015, the company added Amazon Allowance, which was later brought under the Amazon Cash umbrella. Using Amazon Allowance, and with parental consent, kids were able to set up their own Amazon accounts and make purchases using their Amazon Allowance. Parents could allocate recurring funds to their child’s account and get the added control of overseeing what their kids purchased. However, the company discontinued this feature in July 2020.

Amazon has also made investments in improving kids’ access to the platform.

In December 2017, Amazon’s Alexa Fund participated in a $16M Series A to Greenlight Financial, an alternative debit card issuer aimed at young consumers. With the card, parents can manage spending limits and allocate funds for their children through a mobile app. Three years later, Greenlight raised a $260M Series D to launch additional services for its user base of more than 5M parents and children.

Greenlight also announced a partnership with Amazon Kids+, a subscription plan for families that includes books, games, and movies. As part of the collaboration, families with a Kids+ subscription are eligible for a free one-year Greenlight plan.

Greenlight Financial’s core business is complementary with Amazon’s internal initiative of growing Amazon Cash customers by increasing penetration of younger shoppers.

AMAZON CASH’S TRACTION AND METRICS

Amazon hasn’t announced how many customers are using Amazon Cash, but it’s clear the market opportunity is large. A 2021 Economic Well-Being of US Households report found that 5% of the adult population — or around 12M Americans — is unbanked.

The international opportunity is large, too — for example, 190M citizens in India are unbanked and just 37% of adults have a bank account in Mexico. Amazon Cash could be an enabler for customer acquisition in markets that have high unbanked populations and entrenched local competitors, supporting Amazon’s goal of increasing the number of customers that transact on the Amazon platform.

FUTURE DEVELOPMENTS OF CASH-BASED OPS

Amazon is no stranger to looking outside its existing channels for growth opportunities.

The company could continue to expand the Amazon Cash and PayCode programs to other partners with high foot traffic (for example malls, colleges, grocers, etc.) or other geographies with highly underbanked populations and where QR codes are gaining traction as a payment method. Amazon could also leverage Whole Foods to launch more Coinstar kiosks, expanding the reach of the Coinstar partnership in a unique way.

1 comment:

Nice article and thanks for sharing with us.

Amazon wholesale agency

Walmart dropshipping agency

Post a Comment