From payments and lending to insurance and cash deposits, Amazon is attacking financial services from every angle without even applying to be a conventional bank. In this report, we break down how these efforts impact merchants and consumers. We also dive into various initiatives Amazon is pursuing, ranging from cashierless payment terminals to health insurance for sellers.

In 2017, Andreessen Horowitz general partner Alex Rampell said that of all the tech giants that could make a major move in financial services,

“Amazon is the most formidable. If Amazon can get you lower-debt payments or give you a bank account, you’ll buy more stuff on Amazon.”

While the anticipation for Amazon’s plunge into banking builds each year, it’s important to first understand Amazon’s existing strategy in financial services — what Amazon has launched and built, where the company is investing, and what recent products tell us about Amazon’s future ambitions.

Based on our findings, it’s hard to claim that Amazon is building the next-generation bank. But it’s clear that the company remains very focused on building financial services products that support its core strategic goal: increasing participation in the Amazon ecosystem.

As a result, the company has built and launched tools that aim to:

1. Increase the number of merchants on Amazon, and enable each merchant to sell more.

2. Increase the number of customers on Amazon, and enable each customer to spend more.

3. Reduce any buying/selling friction.

In parallel, Amazon has made several fintech investments, mostly focused on international markets (India and Mexico, among others), where partners can help serve Amazon’s core strategic goal.

In aggregate, these product development and investment decisions reveal that Amazon isn’t building a traditional bank that serves everyone. Instead, Amazon has taken the core components of a modern banking experience and tweaked them to suit Amazon customers (both merchants and consumers).

In a sense, Amazon is building a bank for itself — and that may be an even more compelling development than the company launching a deposit-holding bank.

TABLE OF CONTENTS:

- Amazon’s product strategy

2. Amazon Market strategy outside the US

3. Rumors: What will Amazon do next?

4. Closing thoughts

Product strategy: Amazon takes on financial services

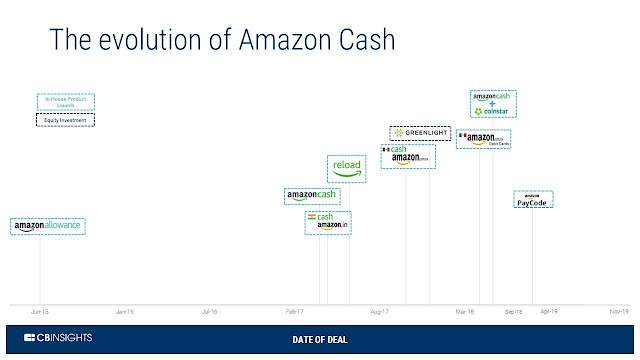

Amazon is notorious for spreading its bets before going all in on a new product, and the financial services space is no exception. Through trial and error, the company has set up key financial pillars across payments, cash deposits, and lending. As we’ll explore below, all are related to Amazon’s broader growth and product strategies.

Amazon Payments

Amazon has aggressively invested in payments infrastructure and services over the last few years. That’s unsurprising, given that the payments experience is so close to Amazon’s core e-commerce business. Making payments more cash-efficient for Amazon and frictionless for customers is a key priority.

AMAZON PAY: A DIGITAL WALLET AND A PAYMENTS NETWORK

Today, Amazon Pay has evolved to include a digital wallet for customers and a payments network for both online and brick-and-mortar merchants. Since 2019, Amazon has invested in growing Amazon Pay’s marketplace, including forming a partnership with acquiring bank Worldpay.

While Amazon Pay is the company’s latest iteration on payments, Amazon has experimented with payments functionality for over a decade. Below is a timeline of some of the major Amazon Pay milestones:

Amazon’s first known payments product, Pay with Amazon, launched in 2007. That same year, the company acquired TextPayMe, a peer-to-peer (P2P) mobile service that was re-launched as Amazon Webpay in 2011.

Webpay failed to gain user traction and was shut down in 2014, unlike up-start Venmo (now a part of rival payments processor PayPal). It’s likely that Amazon was too early to P2P payments.

In 2007, the company also invested in Bill Me Later (fka I4 Commerce). Bill Me Later was one of the earliest fintech payment platforms on the market and gave big retailers the ability to offer flexible financing programs. Although Bill Me Later was scooped up by PayPal in 2008, Amazon remained ever focused on reducing payment friction for customers.

Over the last few years, Amazon has used a variety of techniques to strengthen its payments experience, including launching digital wallets through Amazon Pay, acquiring tech talent of failed mobile payments startup GoPago, building a variety of tech in-house, and most recently opening up to partnering with merchant acquirers outside of Amazon’s marketplace.

Today’s iteration is Amazon Pay, a digital wallet for customers and a payments network for both online and brick-and-mortar merchants and shoppers.

AMAZON PAY’S TRACTION AND METRICS

In addition to serving Amazon’s core customers, payments is an attractive revenue line when thinking about the scope of the payments market. Swipe fees paid by US merchants alone are more than a $110B-a-year business for banks, card networks like Visa, and payment processors like Stripe.

Amazon is finding ways to attract merchants to the Amazon Pay network beyond its experimentation with swipe fees. The company announced it would pass on the special card savings Amazon gets from card networks (because of the volume of purchases they can guarantee) to retailers that adopt Amazon Pay. Leveraging scale and competing on fees is a classic customer acquisition strategy in Amazon’s playbook.

And while the company is famously secretive about reporting customer growth and business metrics, a 2021 survey revealed that Amazon Pay has grown into a major online payment provider with a 24% user share in the US. Payments made with Amazon Pay spiked following service expansion to new geographies — France, Italy, and Spain — and to new verticals, including government payments, travel, insurance, entertainment, and charitable donations.

However, Amazon has had some missteps with Amazon Pay. Its most famous failure was Amazon Local Register. With the talent acquired from GoPago, Amazon launched Amazon Local Register, a card reader for small- and medium-sized businesses (SMBs) in August 2014. At the time, the company charged competitive rates (a full percentage point less than Square). Each reader cost $10, and it seemed like a formidable rival to PayPal’s and Square’s readers.

But in October 2015, the company announced it would be shut down. Despite charging lower fees, the company failed to gain enough traction with merchants who feared giving Amazon detailed data on their overall business operations.

Eventually, Amazon launched a “Pay with Amazon” button for mobile and created a team with the goal of expanding payments across the web and on apps.

To lead this team, Amazon hired ex-PayPal employee Patrick Gauthier. In reference to failed payments projects, Gauthier said:

“What people never realize or truly understand about Amazon is that part of the recipe for success is daring to try things you have no idea whether will succeed or not, and if you think that you have a notion of how to succeed … you try again.”

FUTURE DEVELOPMENTS OF AMAZON PAY: PIVOTING FROM E-COMMERCE TO OMNICHANNEL ENABLEMENT

In March 2019, Amazon announced an integration with Worldpay, which serves as a back-end intermediary between banks and credit card companies and is one of the largest payment processors in the world.

It is a notable pivot from Amazon’s IP strategy, where the playbook has been to build, patent, and keep proprietary technology in-house to fuel Amazon’s marketplace. However, keeping Amazon’s customer-centric “day one” philosophy in mind, Amazon Pay’s top priority is reducing payment friction for customers to buy goods and services and for merchants to sell more things. This is also a second attempt to build distribution with merchants, picking up where Amazon Local Register failed to gained trust.

To achieve this, Amazon Pay set up a rare independent domain and is expanding from e-commerce to omnichannel — across web, mobile, and IoT devices.

The partnership is significant because of its potential to put Amazon’s Quick Payment button in front of millions of consumers and boost distribution with merchants.

At the time of the deal, Worldpay processed more than 40B transactions worth about $1.7T annually, supporting more than 300 payment types across 120 currencies. In July 2019, FIS announced it was acquiring Worldpay in a $43B cash-and-stock deal, indicating a strategic move to grow its merchant solutions business. Patrick Gauthier, VP of Amazon Pay, was reserved about the implications of the partnership:

“Today the announcement is about the extension of our footprint. It will lead us into more opportunities to grow the value proposition for buyers and merchants, but I will reserve discussion about that for the future.”

For Amazon, the combination of FIS and WorldPay is aligned with the company’s goal of reducing friction in payments for consumers and merchants, subsequently boosting commerce.

FIS could also be valuable for financial services pursuits as its suite of technologies ranges from POS systems to integrated card payments to cross-border payments, and covers both online and offline commerce. FIS is also one of the biggest providers of core banking processing and has integrations with Q2 technologies. Both are key elements that non-bank-chartered tech firms in the US have been leveraging to launch banking services, like checking and savings accounts.

Commerce has expanded well beyond desktop into mobile apps, IoT devices such as smart speakers, and other channels where Amazon does not have as formidable a position.

On the web, the infamous one-click patent helped boost the company’s payments prowess. But when the patent expired in 2017, it opened up the market for competitors to launch off-marketplace payment solutions.

To compete, Amazon is investing in its products, including by hiring product managers for device solutions. This has helped Alexa move from the home and office into brick-and-mortar or point-of-sale (POS) environments.

Further, Amazon recognizes the need to diversify its dependence on third parties for its marketplace, even if that means enabling them off-platform.

While a short-term goal of the partnership seems to be to capture market share and reduce the processing fees charged by incumbents, in the long run, Amazon may look to close the loop and keep customers within the Amazon ecosystem.