Wednesday, December 28, 2016

Snapshot of Global Payment Methods

The world has become a far smaller place since the days when tourists would have

to stock up on local currency or convince a restaurant they actually did in fact

accept Travellers Cheques. Nowadays, the onus is on the merchant to do things

the consumer’s way - and this extends to accepting payments.

There is a huge opportunity for merchants in the UK to make themselves more accessible to the global consumer; if they don’t they can be sure their competitors will be more than happy to do so. The UK is the eighth largest international tourist destination, with tourism being responsible for £126.9bn (9.0%) of UK GDP. So from Diner Card to Alipay, MasterCard to iDEAL, supporting a raft of different options for visitors is essential to make the most of this opportunity.

So, what are some of the different global payment methods available and why should retailers care about them?

Visa & MasterCard

The bread and butter of non-cash payments. Although there are a number of lesser known options emerging, retailers should never forget about ensuring the basics. Supporting these is essential for any merchant.

Mobile payments

One of the most popular growing forms of payment has been buoyed by the launch of Apple Pay and Samsung Pay in different global locations, as well as other heavy-hitters in the tech world. Consumers are growing ever more comfortable with contactless payments, so they’re now open to making their mobile phones their ‘go to’ for more than just communication – but paying too. Ensuring mobile payments are accepted will go a long way when winning over the tech-savvy younger tourist.

Diners Club & Discover

A hugely popular method of payment, particularly with North American consumers. What’s more, its uptake is growing in other markets too. By supporting these, merchants will be addressing a substantial part of an affluent market.

Alipay

The biggest payment method you have never heard of. Alipay has the biggest market share in China, with over 300 million users. Over 200,000 Chinese tourists alone visited the UK in the first 9 months of 2015, so the benefits of offering Alipay are huge for merchants wishing to capture these consumers. And, with the UK changing its visa rules for Chinese tourists, we’re likely to see more and more Chinese tourists looking to book hotels and tickets for attractions in the country this year.

Union Pay

The only domestic bank card organisation in China, used in 141 countries and regions across the world, making it the second largest-payment network by value of transactions processed.

iDEAL

The most popular online payment method in the Netherlands. Introduced in 2005, it allows customers to buy on the internet using direct online transfers from their bank account. For online retailers looking to crack the Dutch market, this is a must-have.

JCB

Very big in certain Asian markets including Korea and Japan, and it’s growing in popularity in the U.S as well. Accepting JCB payments would provide a significant advantage to retailers and other merchants in popular UK tourist hotspots like London.

Keeping everyone happy

We live in a global marketplace and this should be at the front of every merchant’s mind. Competition is fiercer than ever and as such they should take whatever action might give them a competitive edge. This requires consideration of each market’s payment culture and meeting those needs as you would for your domestic customers. Whether it is supporting Discover/Diner cards for US tourists or Alipay for Chinese consumers online, retailers will need to work with partners that support the widest range of payment methods or risk getting left behind.

There is a huge opportunity for merchants in the UK to make themselves more accessible to the global consumer; if they don’t they can be sure their competitors will be more than happy to do so. The UK is the eighth largest international tourist destination, with tourism being responsible for £126.9bn (9.0%) of UK GDP. So from Diner Card to Alipay, MasterCard to iDEAL, supporting a raft of different options for visitors is essential to make the most of this opportunity.

So, what are some of the different global payment methods available and why should retailers care about them?

Visa & MasterCard

The bread and butter of non-cash payments. Although there are a number of lesser known options emerging, retailers should never forget about ensuring the basics. Supporting these is essential for any merchant.

Mobile payments

One of the most popular growing forms of payment has been buoyed by the launch of Apple Pay and Samsung Pay in different global locations, as well as other heavy-hitters in the tech world. Consumers are growing ever more comfortable with contactless payments, so they’re now open to making their mobile phones their ‘go to’ for more than just communication – but paying too. Ensuring mobile payments are accepted will go a long way when winning over the tech-savvy younger tourist.

Diners Club & Discover

A hugely popular method of payment, particularly with North American consumers. What’s more, its uptake is growing in other markets too. By supporting these, merchants will be addressing a substantial part of an affluent market.

Alipay

The biggest payment method you have never heard of. Alipay has the biggest market share in China, with over 300 million users. Over 200,000 Chinese tourists alone visited the UK in the first 9 months of 2015, so the benefits of offering Alipay are huge for merchants wishing to capture these consumers. And, with the UK changing its visa rules for Chinese tourists, we’re likely to see more and more Chinese tourists looking to book hotels and tickets for attractions in the country this year.

Union Pay

The only domestic bank card organisation in China, used in 141 countries and regions across the world, making it the second largest-payment network by value of transactions processed.

iDEAL

The most popular online payment method in the Netherlands. Introduced in 2005, it allows customers to buy on the internet using direct online transfers from their bank account. For online retailers looking to crack the Dutch market, this is a must-have.

JCB

Very big in certain Asian markets including Korea and Japan, and it’s growing in popularity in the U.S as well. Accepting JCB payments would provide a significant advantage to retailers and other merchants in popular UK tourist hotspots like London.

Keeping everyone happy

We live in a global marketplace and this should be at the front of every merchant’s mind. Competition is fiercer than ever and as such they should take whatever action might give them a competitive edge. This requires consideration of each market’s payment culture and meeting those needs as you would for your domestic customers. Whether it is supporting Discover/Diner cards for US tourists or Alipay for Chinese consumers online, retailers will need to work with partners that support the widest range of payment methods or risk getting left behind.

Sunday, December 18, 2016

Thursday, November 03, 2016

What is bitcoin? What is blockchain? And what is the difference?

Bitcoin is the world’s first global decentralized digital currency. As a crypto currency, it uses cryptography or math to control the creation and the transactions of bitcoin. These transactions are verified by a network of nodes on a distributed public ledger called blockchain.

Thomas Glucksmann, marketing manager, Gatecoin, is passionate about dispelling the myths around bitcoin. Here are some of them.

“Billions of people around the world are trading, transacting and mining bitcoin, and so it really recreates this global infrastructure that isn’t centralized at any one point. It’s secure, it’s safe, it’s government proof,” he said.

China is the largest trading platform for bitcoin. According to Glucksmann, 91% of global bitcoin trading is against the Chinese yuan and 95% of bitcoin global trading is controlled by exchanges in Mainland China.

The average bitcoin user is a 24-35 year old Chinese man. 97% of bitcoin users are men, according to Glucksmann.

The public ledger component of the blockchain technology used to transfer virtual currencies is the most transparent in the world. “It’s traceable and its permanent.”

Blockchain allows a user to be ‘pseudo anonymous’. For example, if a user makes or receives several transactions from the same wallet address, those transactions can be traced back to the single user. If a user sets up a new address for each transaction, it will become more difficult to trace transactions back to the same person.

However, many exchanges today are now requiring users to submit their passport details for KYC (know your customer) regulatory compliance, either to meet existing regulation or to pre-empt it, Glucksmann said.

Taxation and regulation depend on jurisdiction. In Japan, for example, it is regulated by the FSA. In China, it is viewed as a type of product or value equivalent to a type of property right.

“If you are just going to get the money in fiat there is no risk to you,” said Glucksmann.

Fees are considerably lower than a bank, with many bitcoin payment processes only charging a merchant fee if monthly transactions are above a certain amount. The fiat is then capped at around 1%. “Compare that to a credit card, which can range between 1.9% to even 4% or other payments such as Tenpay, Alipay at around 3%, and it’s still relatively cheap,” Glucksmann said.

Setting up a bitcoin wallet as a freelancer or small business is free.

Thomas Glucksmann, marketing manager, Gatecoin, is passionate about dispelling the myths around bitcoin. Here are some of them.

Virtual currencies have no value

“People always argue that bitcoin doesn’t have an underlying value. But I would argue that the essential value of it is the ecosystem,” said Glucksmann.“Billions of people around the world are trading, transacting and mining bitcoin, and so it really recreates this global infrastructure that isn’t centralized at any one point. It’s secure, it’s safe, it’s government proof,” he said.

China is the largest trading platform for bitcoin. According to Glucksmann, 91% of global bitcoin trading is against the Chinese yuan and 95% of bitcoin global trading is controlled by exchanges in Mainland China.

The average bitcoin user is a 24-35 year old Chinese man. 97% of bitcoin users are men, according to Glucksmann.

Transparency

Lack of transparency is the biggest bitcoin myth of all, Glucksmann said.The public ledger component of the blockchain technology used to transfer virtual currencies is the most transparent in the world. “It’s traceable and its permanent.”

Blockchain allows a user to be ‘pseudo anonymous’. For example, if a user makes or receives several transactions from the same wallet address, those transactions can be traced back to the single user. If a user sets up a new address for each transaction, it will become more difficult to trace transactions back to the same person.

However, many exchanges today are now requiring users to submit their passport details for KYC (know your customer) regulatory compliance, either to meet existing regulation or to pre-empt it, Glucksmann said.

What does bitcoin mean for marketers?

For businesses thinking about accepting bitcoin there are a range of payment processes.Taxation and regulation depend on jurisdiction. In Japan, for example, it is regulated by the FSA. In China, it is viewed as a type of product or value equivalent to a type of property right.

“If you are just going to get the money in fiat there is no risk to you,” said Glucksmann.

Fees are considerably lower than a bank, with many bitcoin payment processes only charging a merchant fee if monthly transactions are above a certain amount. The fiat is then capped at around 1%. “Compare that to a credit card, which can range between 1.9% to even 4% or other payments such as Tenpay, Alipay at around 3%, and it’s still relatively cheap,” Glucksmann said.

Setting up a bitcoin wallet as a freelancer or small business is free.

Mobile payments: the difference between a mobile wallet and a credit card

The credit card might have taken 50 years to reach mainstream adoption, but the speed of mobile wallet adoption is happening much quicker and it is being driven by the consumer, said panelist Paul Tomes, chief executive officer and co-founder, PassKit.

This is particularly relevant for millennials and high-income earners – standouts in their willingness to use a smartphone to make those mobile payments.

“People’s attitudes to using the smartphone are changing. They understand that there is more security and that it can provide more facility. And when you combine payments with a much more holistic view of the customer purchasing experience – because you now have content within the smartphone, that is enhancing people’s lives,” said Tomes.

As an example, Tomes highlighted adoption rates in countries and regions with existing mobile wallets such as Apple Pay, Android Pay .

“It’s when you are combining a payment with something that is adding additional value to the customer. Not just the convenience – but making the intention to purchase easier and being rewarded for that purchase after you’ve made it with your smartphone,” said Tomes.

In 2012, the Starbucks app was one of the few electronic wallets around. The big change since then is the move from branded wallets to smartphone operators like Apple, or big companies like a Tencent or Alibaba, deploying mobile wallet applications that brands can use to deliver an experience to their customers.

With the rise of the bot, the smartphone fits within the value change, allowing a mobile wallet to give consumers a deeper experience when they shop.

“Mobile wallets fit within the value chain because they can greet you in a personalized way, they can make recommendations for what would be useful for you to purchase, they are making your payment more convenient and then they make the ability to retain you as a business more exciting,” said Tomes.

And this is where the difference between a credit card and a mobile wallet becomes evident. It becomes an opportunity to optimize the whole value chain.

“You can deliver a very magical experience to your customers at every moment of intention along that purchasing cycle.”

A marketer can see where a consumer has clicked, when they bought something, or whether they ended up buying something else. It’s now possible to present the consumer with a product in an online store that they are more incentivized to buy. If they like that experience, they are more likely to come back to shop for more, Tomes said.

By applying mobile wallet technology with other customer engagement technologies like beacons and big data, the same cool experience can be replicated in the physical.

“The mobile wallet is well beyond the transaction. The transaction is just one micro moment in a shopping experience, or a travel experience, or a hotel experience. And now we have to think, how do mobile wallet applications help me, as a business deliver that core experience to customers?”

This is particularly relevant for millennials and high-income earners – standouts in their willingness to use a smartphone to make those mobile payments.

“People’s attitudes to using the smartphone are changing. They understand that there is more security and that it can provide more facility. And when you combine payments with a much more holistic view of the customer purchasing experience – because you now have content within the smartphone, that is enhancing people’s lives,” said Tomes.

As an example, Tomes highlighted adoption rates in countries and regions with existing mobile wallets such as Apple Pay, Android Pay .

“It’s when you are combining a payment with something that is adding additional value to the customer. Not just the convenience – but making the intention to purchase easier and being rewarded for that purchase after you’ve made it with your smartphone,” said Tomes.

In 2012, the Starbucks app was one of the few electronic wallets around. The big change since then is the move from branded wallets to smartphone operators like Apple, or big companies like a Tencent or Alibaba, deploying mobile wallet applications that brands can use to deliver an experience to their customers.

What are the opportunities for marketers around mobile wallets?

“If you have a wallet, there are other things inside that wallet that are not just credit cards,” said Tomes.With the rise of the bot, the smartphone fits within the value change, allowing a mobile wallet to give consumers a deeper experience when they shop.

“Mobile wallets fit within the value chain because they can greet you in a personalized way, they can make recommendations for what would be useful for you to purchase, they are making your payment more convenient and then they make the ability to retain you as a business more exciting,” said Tomes.

And this is where the difference between a credit card and a mobile wallet becomes evident. It becomes an opportunity to optimize the whole value chain.

“You can deliver a very magical experience to your customers at every moment of intention along that purchasing cycle.”

A marketer can see where a consumer has clicked, when they bought something, or whether they ended up buying something else. It’s now possible to present the consumer with a product in an online store that they are more incentivized to buy. If they like that experience, they are more likely to come back to shop for more, Tomes said.

By applying mobile wallet technology with other customer engagement technologies like beacons and big data, the same cool experience can be replicated in the physical.

“The mobile wallet is well beyond the transaction. The transaction is just one micro moment in a shopping experience, or a travel experience, or a hotel experience. And now we have to think, how do mobile wallet applications help me, as a business deliver that core experience to customers?”

Wednesday, July 13, 2016

Few Facts on Instant Payments

When it comes to transitioning to Instant Payments, how much is cost a barrier for banks?

Most banks process payments in batches at set times.

By contrast, Instant Payments is an online system that requires

- Continual input,

- Process and

- Output of data.

Put simply payments must be processed as they are received.

This transition has major associated demands and challenges.

- Banks need to both change their internal infrastructure to handle real-time as well as connect to the relevant national payment scheme or schemes.

- Critically the implications aren’t purely technical – there are major operation requirements to ensure governance, not to mention business considerations around how the core system will power forward-looking products and services.

- Sophisticated routing decisions have to be instantly taken, fraud and anti-money laundering checks now need to be handled instantly, and exception-handling processes require automation.

The problem for mid-sized and smaller banks is they only have a sledge hammer to crack a nut.

For example, large global banks may already have a payment hub that they can use in their core markets, but such systems are difficult to customise and costly to deploy in smaller, subsidiary markets.

They are expensive to license, inefficient at lower transaction volumes, and often hide additional professional services fees. The price tag increases further when middleware and database licenses and the requirement for heavyweight infrastructure are factored in.

So yes, cost is one of the biggest barriers, and it is particularly acute for smaller banks asking for a lower cost way to provide the speed of execution their customers need today, and the digital services they expect tomorrow.

What is the risk if the banks don’t embrace this?

When Banks are started talking maybe a year or so ago they were not sure about instant payments, asking what the business case was for it. That has changed completely in the past 12-18 months.

There is a pan-European payments scheme in the pipeline at the moment and all the banks are saying forget about the business case, we have to get on board with this because if we do not offer instant payment and all our competitors are we are out of business. So instead of being a differentiator or a value-add it has become part of the table stakes. If you are a bank you’d better be offering instant payments or else you’ll get left tin the dust.

Difference between Instant, Real-Time, Faster and Immediate Payments?

Fundamentally there is no difference, it is simply semantics.

- In, The UK scheme is called Faster Payments,

- While in Singapore the scheme is called G3 which they describe as ‘Immediate Payments’.

They all refer to the same thing – and that’s moving from an off-line, batch based payments processing system, to an on-line system which processes payments as they are received.

The terms are used interchangeably depending on where you are in the world and who you’re talking to. Instant Payments is the term that seems to be used the most widely in the market.

What is Vocalink?

Whenever we make a payment through internet banking or set up a direct debit, money has to go from your bank to the gas company for example.

As we can imagine there are millions of these payments flying around each day. Rather than each bank paying directly to the other banks, which would mean lots of separate connections between banks, it is easier to have a central hub in middle.

All bank payments go into that hub the hub then sorts them into the right order, sends them on their way and then settles with the Bank of England.

Vocalink is that hub.

- It sits between all the banks,

- Transfers the payment messages &

- Makes sure the money at the end of the day is settled at the Bank of England.

They have been doing that for about 50 years so the tech has changed a lot

But they now look after

- The Bacs (Bacs Payment Schemes, formerly known as Bankers’ Automated Clearing Services),

- Faster Payments and LINK (which is the domestic card payments ATM scheme).

Thursday, July 07, 2016

History of the ATM - In Netherlands

From 1982 to present

The early 1980s saw a revolutionary innovation – a device with a screen and some buttons that allowed customers to withdraw money that they could then spend in the shop. The cash dispensing machine soon became indispensable, but with the rise of bank cards and mobile payments, the hole in the wall has had its day.

The very first ATM in the Netherlands appeared in Limburg at Rabobank Pey en Maria-Hoop on 22 April 1982, to be precise. The rest is history. Other Rabobank Nederland cash dispensing machines quickly followed in 1982 in Utrecht, Eindhoven, Zeist and Best.And the local Rabobanks also installed ATMs en masse.

By 1985, no fewer than 60 ATMs had been installed throughout the Netherlands.

There were 3,300 ATMs in the Netherlands in 1992 and about 1,300 of this total belonged to Rabobank.

ABN Amro and Postbank/NMB did not pass the 700 ATM mark.

And the other Dutch banks had even fewer ATMs.

ATM vs. smartphone

The cash dispensing machine celebrated its 25th birthday in 2007. There was a total of around 9,000 ATMs in the Netherlands that year, of which 3,100 belonged to Rabobank.Many of these were located in assisted care facilities. A portable cash dispensing machine could also often be found at events. The same year the bank introduced the option of mobile payment, a development that Rabobank believed would be met with success.

And it seems the bank was right on the money. Now in 2016, ATMs play only a supporting role. You can pay with your debit card in practically any shop and often at the market too. More and more Rabobank customers can pay by tapping their smartphone against a device at the till. One beep and off you go, all thanks to Rabo Wallet.

At the same time, there are many empty storefronts because online shopping has become the new standard. Innovation has done anything but stop.

The end of cash

Now less cash is in circulation making many experts believe the days of the ATM are numbered. In Sweden, for example, they have set a target to get rid of cash by 2025, when all payments will have to be made through apps or machines. The Scandinavians really are ahead of the rest of us, but it seems the pace has been set. So slowly but surely the question is becoming whether the ATM will be around to celebrate its 45th birthday.Who would have thought this back in 1982 when we were able to get cash from the hole in the wall for the first time?

Wednesday, July 06, 2016

Monday, June 27, 2016

Friday, June 24, 2016

Friday, June 17, 2016

Thursday, June 16, 2016

Wednesday, June 01, 2016

Could blockchain be the backbone of a universal digital identity system? - From American Banker

Innovative banks are increasingly seeing their future as the stewards of identity — they would serve as the authenticators. Such a system would allow consumers to use a digital token to verify their age when ordering a beer or to log on to an e-commerce site.

But several blockchain companies are looking to play a vital role in the future of identity. In theory, blockchain technology enables entities independent of each other to rely on the same shared, secure and auditable source of information in a way that fits well with a system of widespread digital identity.

Gem, a startup in Venice, Calif., is focused on getting companies within the same industry to share information via blockchain technology. For banks, one possible solution would be in know-your-customer compliance — bank users would be able to vet a customer by relying on the work another bank has already done. Another is London-based Credits.Vision, which is looking to create a blockchain of blockchains, connecting various permissioned and public systems so that a digital identity could be truly universal.

As banks plot their future in identity, many may look to partner with blockchain companies also eyeing the space. Suresh Ramamurthi, the chairman and chief technology officer of CBW Bank in Weir, Kan., sees digital identity as a practical use for blockchain. His bank, like many others, has been seriously investigating the possibilities of the blockchain. For instance, it has partnered with the distributed ledger firm Ripple for instantaneous cross-border transactions.

As banks plot their future in identity, many may look to partner with blockchain companies also eyeing the space. Suresh Ramamurthi, the chairman and chief technology officer of CBW Bank in Weir, Kan., sees digital identity as a practical use for blockchain. His bank, like many others, has been seriously investigating the possibilities of the blockchain. For instance, it has partnered with the distributed ledger firm Ripple for instantaneous cross-border transactions.

"We have the basic technology," he said, referring to blockchain. "When you already have a wheel, you can make a wheelbarrow, or a car. People are discovering any number of ways" to use the blockchain.

He also sees it as a potential accelerant and enabler for the adoption of a digital identity system.

"The technology is not very complicated; this is something we could do now," Ramamurthi said of a universal digital identity. "Banks already have to verify identity for KYC; expanding that across the Internet is not a very big leap."

As Micah Winkelspecht, chief executive and founder of Gem, sees it, banks' role in digital identities would be to serve as authenticators.

"Rather than the banks being in control, should the customer be in control of certain information they could then passport around?" he asked. "There's a good argument to be made for both sides. But banks certainly could act as a certifying body for individual identity on the blockchain."

Using a distributed ledger system would also allow people to retain authority over their identity, Winkelspecht says.

"With blockchain you have the same conveniences of a centralized ID authority but without having to turn over power to a third party."

But in that scenario, banks would still benefit, he said. Today, every time a consumer goes to a new bank for services they are KYC-vetted, even though one bank has already verified them as a customer, he said, adding that this problem is multiplied at large banking institutions where a customer must get verified for KYC compliance over and over again within different departments.

Gem argues that if a group of banks shared a KYC blockchain, institutions could cut costs on KYC collection software. With a shared ledger system built on public key cryptography, banks could authenticate the consumer, and certificates attached to that key could authorize the consumer for certain functions, he said. Besides banking, Gem is partnering with industries like health care on creating blockchain networks to establish trust and transparency and share information between organizations.

Like Gem, Credits.Vision sees creating a better way for banks to share information as an important step in creating a federated digital identity, said Nick Williamson, its chief executive.

The firm is working on creating a blockchain that would connect other blockchains, both private ones being tested by banks and public ones like the bitcoin blockchain. One function of this project could be used for identity, where a consumer could upload their personal details (in encrypted form) once, whether with a bank, passport office, or telecom provider and the identity could then be used in any other context.

Williamson sees the real potential of blockchain technology as a next-generation, open and interoperable form of public key infrastructure. PKI was developed in the 1970s to secure communications — Bob encrypts a message to Alice with her public key, and only she (or someone who has her private key) can decrypt it. In theory, it's a great way to manage identity, since a message signed with Alice's private key could only have come from her (assuming the key hasn't been compromised). But it's never caught on as a mass-market technology.

"Key distribution has always been a gigantic pain point preventing widespread adoption of consumer-focused PKI," Williamson said. Combining blockchain with PKI could address adoption. From there, banks and others could rely on blockchain's transparent and immutable settlement characteristics "as part of your stack for the onboarding, distribution, and revocation of keys in a way that can be portably transported across independent blockchain networks."

While banks may serve as the ideal authenticators and potential holders of a digital ID, one obstacle that would need to be overcome is banks' willingness to share data and cooperate, something they've not always been keen to do, said Andy Schmidt, principal executive adviser at the consulting firm CEB.

"A difficulty with that model is that it presumes you have one banking relationship," he said. "Most consumers have more than one; if you are able to take your various banking relationships and then designate one bank [as your ID authenticator] that could work, but then all the banks involved would have to share data. Are they willing to give up some control in order to create value for a customer?"

There would "definitely be some security concerns" over such a model, Schmidt said, but ultimately, he said, a blockchain-powered universal identity would still be better than the current personal information-intensive model currently used. For instance, Winkelspecht said, the current method of password-based online authentication is faulty, since consumers have to remember different combinations of usernames and passwords for any number of websites. Also, Winkelspecht said, many reuse the same password multiple times, which facilitates fraud.

"There's no perfect solution," Schmidt said, "so there's a potential downside to any idea. But the downside to this is less than the downside to the current methods we have. I think the blockchain is the most enabling and disruptive technology any of us have seen so far. If harnessed properly, it will revolutionize the way we exchange information."

Although Ramamurthi said he believes there are no technology hindrances to creating a universal, federated identity, he said it will not happen until governments become involved in driving this. He pointed to digital ID initiatives in Estonia and in India that have seen widespread adoption and were the result of government drive to institute them.

But ultimately, he said, if there is a will to do this, there is already a way.

Despite the hurdles, such as compliance and security concerns and government cooperation, in creating universal digital ID, Gem's Winkelspecht is confident it will one day happen.

"People have to stop thinking about blockchain as fintech; it's not fintech, it's about how do we build a global computer," he said. "And if you have that, how then do we log into the global computer?"

Tuesday, April 26, 2016

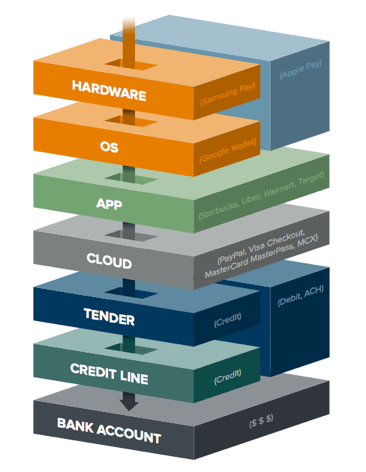

Why your wallet is becoming the next platform

The “wallet” in the modern sense of “flat case for holding paper currency” dates back almost 200 years. The word itself goes back 700 years, and the concept (minus paper currency) for millennia.

Leather wallets were not “smart,” of course; they were atom agnostic, payment type agnostic, even, as credit cards and the like started proliferating in the mid 20th century. But today the payment type is almost a pointer — in computer science vernacular — to a source of money. And the wallet itself is the master pointer, used for opening and closing a transaction, and choosing which sub-pointer to assign.

Because intercepting the payment leads to a whole downstream treasure of goodies, the wallet — once tanned animal hide — is going to be the ultimate financial platform. As digital wallets increasingly become the origination point for consumer spending, they will become THE platform for downstream financial services — creating an opportunity for startups and a problem for established players.

The problem, of course, is that a payment type can become a wallet, and a wallet can become a payment type. So which is which? If a ridesharing company has 100 million credentials, they’ve solved half of the network effect problem of being a payment company — so you could imagine using that app as your wallet at, say, Walmart. Or Starbucks, which is one of the biggest wallets, has a pointer within its wallet to Visa Checkout, another wallet, pointing to a card type (a Visa card, or even a MasterCard/Amex/Discover card), pointing to a “loan” (the “credit” part of a credit card), ultimately pointing to a bank account.

As a stack, we have hardware — your mobile phone — at the top and bank accounts holding the actual treasure at the very bottom. But it’s better to think of this “stack” as really a system of pointers, in this case downwards. And the goal for businesses is finding and occupying a defensible position in this stack that allows them to intercept payments, capturing and controlling value to become that ultimate financial platform.

Photo courtesy Andreessen Horowitz.

On my Apple iPhone, I can run the Uber app and pay via PayPal, which deducts the money from my American Express Card. For the first four components of the stack — hardware, operating system, app, and cloud backbone — the heuristics of success for capturing value are the number of integrations (i.e., the number of places people can use the wallet) and number of credentials (users who have committed more than one tender type).

Given the massive number of credentials they have and the controlling position as the “start” of the stack — unlike other players, Apple has both hardware and OS — Apple’s wallet as platform could deal a crippling blow to everyone down the stack.

Especially because the flow in this stack only goes one way: players below don’t get access to the resources up the stack.

In a mobile-only world, a well-coordinated effort to let you simply touch your thumb to your iPhone to pay on any ecommerce site or app could wipe out probably 20% of PayPal’s revenue, overnight [two-thirds of PayPal revenue is merchant services off eBay; assume 25% iOS share].

The real value of occupying a defensible place in this stack is not even in processing the payment, however. Capital One spends a lot of money every year convincing you to apply for and use its credit card. Once subsumed under a digital wallet, though, that “usage” component gets further and further out of Capital One’s control, with tremendous implications on downstream interest (lending) revenue.

One change in Apple’s product design — for example, something as simple as alphabetization, which a leather wallet doesn’t do! — could move Bank of America ahead of Capital One as a “default,” moving more purchases in that direction.

The “end result” of this whole system of pointers is usually an increasing balance on a revolving credit facility — a credit card. Take LendingClub and Prosper, the two biggest marketplace lending companies.

About half of LendingClub’s loan originations come from refinancing credit card debt, which they source via U.S. Postal Service mail ads, Google ads, etc. But controlling a position in the purchase stack could and arguably should replace their normal customer acquisition process; rather than waiting for a consumer to accrue a large balance from a series of purchases (at a ridiculously high credit card interest rate) and then refinance, catch it as the balance comes in from purchases.

The next large consumer finance company is likely to interrupt this chain of pointers. But at which point in the stack? It will be very challenging to attack the top of the stack as that would require a hardware+OS wallet with massive adoption and a massive number of payment credentials. And attacking the bottom of the stack is challenging as well …and relatively unprofitable at that.

Right now, LendingClub will take your 18% APR Chase/Citi/et al interest rate and refinance it down to 10%. But in a world where ApplePay controls the front and existing banks like WellsFargo provide the source of funds at the end, there’s no reason not to “automate away” the credit selection process. Why wouldn’t they just skip right to the rate LendingClub would have given you, or even skip to the best “marketplace lending” rate?

The biggest dislocation once that happens will be that your “credit card” will no longer be the default source of medium/long duration credit. This has major implications for all of consumer finance.

The future: Wallet apps, rewards, insights

For credit card companies, the smartest thing they can do is to not build their own cloud wallet, which creates an unnecessary “sub-pointer”. Yet many of them are doing this because they’re missing the full view of where value lies in the stack and how to better leverage their position within it.

For cloud wallets — which are facing the existential challenge of being caught, literally, in the middle — the smartest thing they can do is align themselves with a winning application wallet if they’re losing in acquiring enough credentials on their own. Because payment companies (e.g., Chase, Citi, etc.) risk being abstracted into irrelevance, attaching themselves to the winning application wallets (the likes of Amazon, Lyft, Starbucks, Uber, etc.) is one of the only ways to prioritize their existing “pointer” vis-a-vis others.

So what does this all mean for startups? Well, it will become easier to address the most profitable part of the stack — lending — without getting into the herculean and quixotic path of payments. Companies like PayByTouch over 8 years ago and Powa more recently together evaporated over $500M before dissolving into bankruptcy. Today, there are many other parts of key infrastructure that can be rewritten with access to digital wallet-as-platform: rewards, PFM (personal financial manager, à la Quicken/Mint), merchant recommendations, offers, etc.

There is also a whole generation — millennials — who don’t understand the notion of balancing a checkbook because they don’t even have a checkbook.

It’s an anachronism, as are the PFMs that grew up around that notion, including long delays before purchases show up in “modern” PFMs.

This is because the purchase goes from merchant, to merchant bank, to network, to issuing bank, to aggregator, to PFM. But in digital wallets, purchases show up instantly — allowing recommendations, offers, and discounts to be instantaneous. Digital wallets may finally enable the long-sought “taste graph” (the mother of all “people who bought this, also bought that”) to be built.

All of this will require the “top” of the stack to open up — for Apple, Google, and other players to recognize they are building a financial platform, which like all platforms are most valuable when developers have access. Given the size of the market, it’s a question of when, not if, this will happen. And once it does, it’s likely to be a game changer for the banks that for decades have relied on branches and consumer branding, and for startups who will finally find themselves with a capital-efficient entry point for disrupting consumer finance.

Tuesday, April 19, 2016

Mobile wallets revenue will pass €1 billion by 2021

The forecasts are promising, but is the fragmentation of the digital wallet industry causing confusion for retailers and affecting adoption?

A newly published report from Smart Insights has revealed that mobile wallet transactions in the European Union will grow by 61.8% over 2016-2021. As a result, total mobile wallet revenue for the payments industry is forecast to surpass the €1 billion bar by 2021.

In Europe, the digital wallet industry has driven good customer and retailer awareness of the technology’s benefits. But, compared to China, for example, the market has not seen any examples of mass adoption yet. One of the two main Chinese players, WeChat, saw 420 million people sending 8.08 billion “red envelope” digital payments over Chinese New Year alone.

In Europe, the digital wallet industry has driven good customer and retailer awareness of the technology’s benefits. But, compared to China, for example, the market has not seen any examples of mass adoption yet. One of the two main Chinese players, WeChat, saw 420 million people sending 8.08 billion “red envelope” digital payments over Chinese New Year alone.

Part of Europe’s slow adoption may be due to the large and varied number of players launching in the market, from financial institutions to mobile companies and even retailers themselves.

Forrester’s latest report on digital wallets argues that, despite the confused market, digital business executives need to put adoption strategies in place now, or risk missing the opportunity. But in what is a complex ecosystem, Forrester believes that adoption will continue be slower than expected.

In the UK, the recent launch of the Payment Systems Regulator (PSR), the new economic regulator for payment systems industry in the UK, aims to counteract this confusion by promoting effective competition in the payments market. It will also support innovation in payments and encourage payment system environments that operate in the interest of users.

Thursday, April 07, 2016

Tuesday, March 29, 2016

Monday, March 28, 2016

7 EMV BIG DATA POINTS - In US

Visa

More than 212 million Visa cards were issued with EMV chips by Dec. 31, and more than 766,000 merchant locations accept Visa EMV cards. There are now more chip cards in the U.S. than in any other country, Visa says

MasterCard

According to MasterCard, 59% of its U.S.-issued consumer credit cards had EMV chips as of Dec. 31, and more than 800,000 merchant locations can accept EMV MasterCard products. It did not provide an exact number of EMV cards issued.

Consumer Adoption

Seven out of 10 Americans have at least one EMV-chip card in their wallet, according to Visa research, and about 93% of consumers are aware of the EMV migration whether or not they have a chip card.

Global Shift

It's not just the U.S. that's adopting EMV at a rapid pace. According to EMVCo, a third of payments worldwide were made with an EMV card as of mid-2015. In Western Europe, that's a staggering 97% of all card payments; in Latin America, 87% and in Africa and the Middle East it's 84%, according to data published in December.

Chargebacks Rise

The Oct. 1, 2015 liability shift, which moved EMV fraud liability to the company that was unable to handle EMV cards, is starting to take its toll. The Kroger grocery chain reports operating costs rose 23 points during the final quarter of 2015, in part from higher chargeback losses.

Gift Card Consequences

As the EMV shift continues, fraudsters are paying more attention to gift cards. Many scammers are using counterfeit credit or debit cards to buy gift cards at non-EMV merchants, causing some of those merchants to restrict the way they sell gift cards, according to gift card giant Blackhawk Network.

Web Commerce Woes

It has long been expected that the shift to EMV at the point of sale would drive more fraud online — and that the fraud migration would begin even before EMV took hold. According to research from Forter, overall fraud attempts increased 163% in the first three quarters of 2015, with digital goods seeing a spike of 254% in attempted fraud.

Monday, March 21, 2016

Friday, March 18, 2016

Value of Customer Data

Perhaps the most significant element of any business strategy – digital or otherwise – is understanding the ever changing needs and wants of customers. The landscape is littered with scores of businesses that have lost market share because they were not able to capitalize on changing customer behavior trends. So, having and being able to analyze data that provides insights into customers’ preferences is crucial to the survival of any business.

Big data analytics is the process of collecting, organizing, and analyzing large data sets containing a variety of data types (hence the name big data) to uncover hidden patterns, unknown correlations, market trends, customer preferences, and other useful business information.

This data is then used to determine the appropriate business strategies to meet the customers' current needs, and to anticipate their future needs. The successful players in the digital space not only understand their target customers’ needs, but they are actively engaged in influencing what customers want. Just think about the of customers who are willing to stand in long lines – sometimes for days – just to be the first to get the new Apple iPhones.

Now to apply Digital business concepts to banking, it’s worth noting that Chris Skinner in his book Digital Banking, asserts that "As a digital business, all banking can be broken down into pure bits and bytes, but more than that, a bank can be seen as three digital businesses in one. It is a manufacturer of products, a processor of transactions, and a retailer of services." Based on this premise, banks must begin to understand the shifting expectations of their customers, and develop strategies to meet – and exceed those expectations in an increasingly Digital world.

Another useful concept to consider, as it relates to developing a Digital Strategy, is “Buyology.” Buyology, as defined in Martin Lindstrom's 2008 bestselling book Buyology: The Truth and Lies About Why We Buy, is a term that describes the process of analyzing the factors that influence buyers' decisions in a world cluttered with messages such as advertisements, slogans, jingles, and celebrity endorsements. From a business perspective, this means understanding the core reasons why people buy, and creating opportunities to repeat that buying behavior again and again.

Now we have already seen that banks have been collecting and utilizing digital customer information for decades, so the accumulation of customers’ big data is already occurring.

The next step is analyze this customer data to determine which products are doing well, and which are failing, and why they are doing well or failing.

Are there data points to indicate which customers prefer certain products, and which prefer other products? Keep in mind, one size does not fit all. Big data will also indicate which of the banks’ customers are initiating financial transactions by the banks competitors, which means your customers have purchased products and services from your competitors.

Big data can provide other useful analytics such as:

- Are your customers using the branches? ATMs? Internet? Mobile? If your customers are primarily using mobile devices to make deposits, then you should be communicating to them via their mobile devices to better understand their needs. If they use the Internet via a laptop or computer, then push email messages to them inviting their feedback on the service they receive from your bank.

- Are your customers making loan payments to other lenders from their checking account with your institution? Then you should be offering them the option to convert the loan or consolidate it to your bank at a better rate, because you already know how much they pay each month, and for what type of loan. And since they are your customers, you already know whether they are credit worthy or not.

- Are your customers making payments to other credit card accounts from their checking account with your institution? You should consider offering your customer a credit card with a balance transfer option.

- Are your customers physically depositing payroll checks in the branches rather than using Direct Deposit? Then your tellers should be trained to recognize the opportunity to discuss the benefits of direct deposit with these individuals.

- Are your customers coming into the branch to cash payroll checks that are drawn on your bank? Then someone should be discussing with them the benefits of opening a checking account or obtaining a prepaid payroll card from your bank so they can take advantage of direct deposit, Internet banking, online commerce, and shorter checkout lines at stores.

- Are your customers using convenience checks from other credit card companies to pay down their credit card balances on your credit card? Why didn’t your bank offer these obviously credit-worthy customers the opportunity to pay down balances on your competitors’ credit cards?

Monday, March 14, 2016

Why All of The Interest in Digital Now?

Financial Institutions and their customers have been engaging in Digital Banking for decades, which leads to the obvious question of why all of the interest now in digital banking?

Well, for one thing, until recently, most banks’ attempts at “Digital strategy” have often been reactive and inconsistent.

In the past, banks’ IT departments have generally taken the lead for implementing digital technology to streamline processes, cut costs, gain efficiencies, etc. But these enhancements primarily benefitted the banks’ interests.

And if, along the way, the customer experience was improved, that was considered lagniappe. But it was NOT the banks’ main goal.

And up until the last decade, the only way customers could communicate directly with their bank was through the branch, by mail, through the call center, or the ATM. But recent advances in Digital technology have changed all of that.

In particular, the personal computer, the Internet, high-speed broadband connections, wireless technology, and mobile devices have now enabled customers to dictate to businesses the manner in which they (customers) choose to interact with the businesses (Remember the Lending Tree commercials where banks compete for customers’ business?).

As a result, some visionary entrepreneurs have launched hugely successful “virtual” businesses (no physical storefront or inventory) built on the operating concept of leveraging digital technology as their sole means of engaging in commerce with customers. This has turned the entire merchant/customer relationship on its head. So, in order to compete in a rapidly changing marketplace, traditional brick and mortar companies are now responding at breakneck speeds to catch up with their digital competitors.

Well, for one thing, until recently, most banks’ attempts at “Digital strategy” have often been reactive and inconsistent.

In the past, banks’ IT departments have generally taken the lead for implementing digital technology to streamline processes, cut costs, gain efficiencies, etc. But these enhancements primarily benefitted the banks’ interests.

And if, along the way, the customer experience was improved, that was considered lagniappe. But it was NOT the banks’ main goal.

And up until the last decade, the only way customers could communicate directly with their bank was through the branch, by mail, through the call center, or the ATM. But recent advances in Digital technology have changed all of that.

In particular, the personal computer, the Internet, high-speed broadband connections, wireless technology, and mobile devices have now enabled customers to dictate to businesses the manner in which they (customers) choose to interact with the businesses (Remember the Lending Tree commercials where banks compete for customers’ business?).

As a result, some visionary entrepreneurs have launched hugely successful “virtual” businesses (no physical storefront or inventory) built on the operating concept of leveraging digital technology as their sole means of engaging in commerce with customers. This has turned the entire merchant/customer relationship on its head. So, in order to compete in a rapidly changing marketplace, traditional brick and mortar companies are now responding at breakneck speeds to catch up with their digital competitors.

Thursday, March 10, 2016

Is DIGITAL Banking a new?

DIGITAL Banking is a BUZZ word in the market. I have a doubt whether this is new.

Now with all of the talk these days about Digital Banking, it's important to note that banks have been using Digital technology since the early days of the commercial use of the computer.

Consider that when someone opens a checking account, he/she is provided with an account number. This number, along with the customer's personal information, and the amount of money deposited into the account is stored on the bank’s computer.

Every time a deposit or a withdrawal is made, either a deposit slip or check with MICR encoding (Magnetic Ink Character Recognition) is "read" by a computer to record the transaction and update the customer's account balance.

Banks have long used high-speed Digital check processing equipment that can process tens of thousands of checks per hour to update customers' account balances.

In checking account transactions where a check is deposited into a different bank than where the checking account is housed, the settlement of this item becomes a Digital transaction because no physical cash is actually moved from one bank to the other. Instead, the banks electronically exchange bulk Digital files of all transactions via ACH (automated clearinghouse) to reconcile banks’ customers' account balances.

A similar process happens for loans, lines of credit, and credit cards. There is no physical cash that moves between a seller and a purchaser. Rather, loan balances are maintained on computers that record customers' use of the loan proceeds to make purchases and then reconcile the transactions against the customer's account balances.

In the old days, when customers presented credit cards to make purchases, merchants used paper receipts to imprint the credit card number, and then they had to call the card issuer for approval of the transaction. The paper receipts were then sent to banks to be digitized so the transactions could be recorded against the cardholders’ account balances.

Then when the credit card companies began to use Digital technology that allowed Digital credit card terminals to communicate with over telephone lines (remember the modem) directly with the card issuers’ computers, the payment transaction became even more efficient.

ATM and Debit Card issuers also utilized this Digital communication technology to streamline the access to funds in customers’ checking accounts by allowing merchants to immediately verify whether sufficient funds are available for purchases and then place holds against the balances for the amount of the purchase.

Now with all of the talk these days about Digital Banking, it's important to note that banks have been using Digital technology since the early days of the commercial use of the computer.

Consider that when someone opens a checking account, he/she is provided with an account number. This number, along with the customer's personal information, and the amount of money deposited into the account is stored on the bank’s computer.

Every time a deposit or a withdrawal is made, either a deposit slip or check with MICR encoding (Magnetic Ink Character Recognition) is "read" by a computer to record the transaction and update the customer's account balance.

Banks have long used high-speed Digital check processing equipment that can process tens of thousands of checks per hour to update customers' account balances.

In checking account transactions where a check is deposited into a different bank than where the checking account is housed, the settlement of this item becomes a Digital transaction because no physical cash is actually moved from one bank to the other. Instead, the banks electronically exchange bulk Digital files of all transactions via ACH (automated clearinghouse) to reconcile banks’ customers' account balances.

A similar process happens for loans, lines of credit, and credit cards. There is no physical cash that moves between a seller and a purchaser. Rather, loan balances are maintained on computers that record customers' use of the loan proceeds to make purchases and then reconcile the transactions against the customer's account balances.

In the old days, when customers presented credit cards to make purchases, merchants used paper receipts to imprint the credit card number, and then they had to call the card issuer for approval of the transaction. The paper receipts were then sent to banks to be digitized so the transactions could be recorded against the cardholders’ account balances.

Then when the credit card companies began to use Digital technology that allowed Digital credit card terminals to communicate with over telephone lines (remember the modem) directly with the card issuers’ computers, the payment transaction became even more efficient.

ATM and Debit Card issuers also utilized this Digital communication technology to streamline the access to funds in customers’ checking accounts by allowing merchants to immediately verify whether sufficient funds are available for purchases and then place holds against the balances for the amount of the purchase.

Subscribe to:

Comments (Atom)